Uncertainty for buy-to-let landlords after tax changes

Last month I spoke at the 2015 Yorkshire Bank buy-to-let seminar in Doncaster about the recent buy-to-let tax changes. Now, following the Chancellor’s latest Autumn Statement, more changes are on the way…

The buy-to-let market is thriving, but the government’s recent tax changes for landlords, announced in the Summer Budget and last week’s Autumn Statement, will significantly increase landlords’ tax bills and, in some cases, to a massive extent. This article recaps some of the key discussions from that seminar as well as the Autumn Statement’s further big buy-to-let tax changes and what they mean for landlords and investors.

Is this the end of the boom in buy-to-let?

Restrictions on interest relief

This is the change that will hit landlords the hardest. It is a move which will see interest relief gradually restricted to basic-rate tax, to ‘level the playing field for homebuyers and investors’ (according to the Chancellor).

Landlords will be able to obtain tax relief as follows:

- In 2017-18 the deduction from property income (as is currently allowed) will be restricted to 75% of finance costs, with the remaining 25% being available as a basic rate tax reduction.

- In 2018-19, 50% finance costs deduction and 50% given as a basic rate tax reduction.

- In 2019-20, 25% finance costs deduction and 75% given as a basic rate tax reduction.

- From 2020-21 all financing costs incurred by a landlord will be given as a basic rate tax reduction.

This restriction will mean that buy-to-let landlords will no longer be able to deduct all of their finance costs from their property income. The mechanics of the restricted relief will mean that some taxpayers who are currently only liable at the basic rate will be subject to higher rate tax, and could result in some losing the benefit of their personal allowance.

The impact for landlords with several properties could be huge.

Stamp duty changes ahead – a new Stamp Duty Land Tax 3% surcharge

On top of that big change, the Chancellor has now made life even harder for landlords by increasing stamp duty. On Wednesday, in last week’s Autumn Statement, he announced a new 3% surcharge on stamp duty when a person buys an additional residential property that costs more than £40,000.

This 3% will be in addition to current stamp duty rates, which would see any property valued between £125,001 and £250,000 move from stamp duty payable of 2% to stamp duty payable of 5%, for example.

An extra 3% may not sound like a lot, but it will bring about a a substantial increase in stamp duty payable. For instance, a £200,000 buy-to-let will see its stamp duty bill increase from £1,500 to £7,500 when the new rates come into effect.

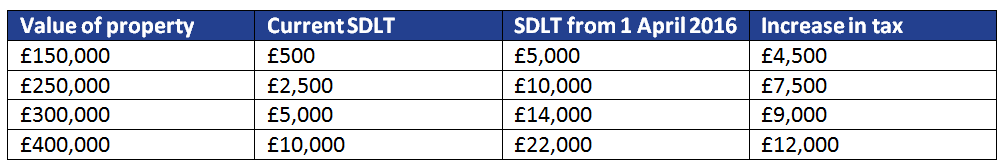

Some other examples are summarised below:

As the table shows, a landlord looking to buy an additional property valued at £150,000 will pay as much as ten times more stamp duty tax when the new rules come into play.

This new rate will come into force from 1 April 2016, but certain property developers could be exempted from the new restrictions. We await confirmation and further details on any exemptions, with the details of the proposal subject to consultation.

It will also be interesting to see how the government determines what qualifies as a second home and, perhaps more importantly, whether the surcharge applies to those who are unsure how the property will be used following the purchase.

Removal of the wear and tear allowance

There have been some recent changes to the amounts that can be claimed as repairs or replacements for landlords of residential properties but, despite these changes, the government is proposing further legislation in this area to be introduced from April 2016.

During the summer Budget the Chancellor announced that the government would be scrapping the current 10% wear and tear allowance for furnished property, and replacing it with a tax relief which will allow landlords to the costs actually incurred. We have produced a more detailed explanation of the changes to repairs and replacements here.

Accelerated capital gains

As well as a 3% surcharge in stamp duty, the Chancellor also announced last week an acceleration of capital gains tax payable on disposals of certain property. From April 2019 individuals selling properties will have to pay capital gains tax within 30 days of the sale rather than, as it currently works, in the January following the tax year of the disposal.

This will not affect gains on properties which are not liable for capital gains tax due to Private Residence Relief. This measure is yet another blow for landlords.

Are landlords under attack from the government?

The Chancellor has been looking at buy-to-let landlords all year, with big tax changes in the July Budget and, once again, in last week’s Autumn Statement. Landlords may have been expecting further changes after being hit hard by the removal of the 10% wear and tear allowance and the gradual reduction of the interest relief in the summer, but these new measures will be a shock.

It is clear that the Chancellor is trying to use the tax system to benefit first-time buyers. Statistics show that fifteen years ago more than 2 in 3 people under 35 owned their own home; those figures are expected to be just half of that next year.

The Chancellor is well aware of this looming housing crisis and is doing what he can to help first-time buyers get on the property ladder…but who will really lose out? It may well be that tenants lose out as buy-to-let landlords raise rents to pass on the tax additional costs.

So is it time to say bye to buy-to-lets?

The buy-to-let market was not so long ago a very financially attractive proposition for those wishing to invest in property, but with big buy-to-let tax changes in the pipeline, the future is uncertain.

In the short-term we could see an upsurge in the number of property transactions before the additional stamp duty rate applies in the new tax year. This is because those who are considering investing in buy-to-let properties could now decide to accelerate their plans, given the significant likely tax-savings available. An increased appetite to buy could then push up house prices even further.

In the longer-term, we could see fewer buy-to-let landlords enter the market, as other investments could now be a more tax-efficient opportunity.

Landlords who already have invested interests in properties and own buy-to-let portfolios may also be considering their options; they could accept a smaller yield and hope for increasing in house prices in the long run, or they could even look to exit the market.

There are a number of things that landlords will need to consider – such as reducing borrowings, transferring property, selling property, incorporating, postponing refurbishments and repairs – and, as always, it is absolutely essential to take professional advice before you make any decisions.

More from our property experts

You can find all of our latest property and construction sector news here.

If you are looking for advice in a particular area, please get in touch with your usual Hawsons contact.

Alternatively, we offer all new clients a free initial meeting to have a discussion about their own personal circumstances – find out more or book your free initial meeting here. We have offices in Sheffield, Doncaster and Northampton.

Stephen Charles is a tax partner at the firm, specialising in corporate and business taxation. For more details and advice, please contact Stephen on sac@hawsons.co.uk or 0114 266 7141.[/author_info]