Women face the larger financial burden Divorce can be a very difficult time emotionally and financially for those involved. It can be especially difficult in later life due to the fact that married couples will have built up financial assets together. These joint...

Latest News

State Pension Age Increases – Start Retirement Planning Now

State pension age increases to 66 years’ old It's Official! From 6 October 2020 men and women in the UK will now have to wait until their 66th birthday to receive their state pension. UK residents born between 6 October 1954 and 5 April 1960 will now receive their...

Natasha Fathers is appointed as Director of HWM

Natasha Fathers Appointed Director of HWM The Directors of Hawsons Wealth Management Limited voted unanimously to promote Natasha Fathers Chartered ALIBF AdvDipFA PETR CertLTCP to Director and welcomed her to the Board. After 5 years with the company, she has...

Hawsons Wealth Management have TWO Chartered Advisers

Hawsons Wealth management have TWO Chartered Advisers Natasha Fathers PETR CertLTCP Adv DipFA Chartered ALIBF becomes the latest adviser within Hawsons Wealth Management Limited to gain the Advanced Diploma in financial services and now joins Nigel Smith CeMAP CeRER...

Brexit: impact on investments, pensions and tax

Brexit: impact on investment, pensions and tax On 23rd June 2016 the UK voted to leave the European Union. Brexit has created an air of uncertainty and no one really knows what’s coming next or what it could all mean in the long term; however, many individuals are...

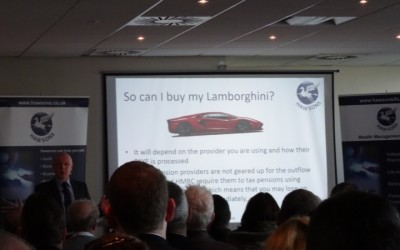

Pension scams – warnings to those approaching retirement

Pensions scams Those approaching retirement are being urged to be aware of a rise in pension scams, as criminals seek new ways to defraud pensioners. Savers have been urged to be aware of a rise in pension scams, as criminals seek new ways to defraud pensioners....

Savers plan big pension withdrawals after changes

Savers plan to withdraw an average £27,000 Amid greater flexibility in the pensions market, with new freedoms introduced on 6th April 2015, savers are planning to withdraw large sums from their retirement fund this year, a study has found. A study commissioned by...

Key Person Insurance a wise move for many

Key Person Insurance a wise move for many As you’ll know, in any business, insurance is a basic safeguard of livelihood and future stability. Business protection is all about insuring for the unexpected; protecting your business if something goes wrong. Making sure...

What Budget 2015 means for pensions

What Budget 2015 means for pensions After the revolutionary pension reforms and new flexibilities that came from the 2014 Budget, this year, in comparison, announced only minor changes. The further changes to pensions that the Chancellor introduced in the 2015 Budget...

Women in Later Life Divorce

Women face the larger financial burden Divorce can be a very difficult time emotionally and financially for those involved. It can be especially difficult in later life due to the fact that married couples will have built up financial assets together. These joint...

State Pension Age Increases – Start Retirement Planning Now

State pension age increases to 66 years’ old It's Official! From 6 October 2020 men and women in the UK will now have to wait until their 66th birthday to receive their state pension. UK residents born between 6 October 1954 and 5 April 1960 will now receive their...

Natasha Fathers is appointed as Director of HWM

Natasha Fathers Appointed Director of HWM The Directors of Hawsons Wealth Management Limited voted unanimously to promote Natasha Fathers Chartered ALIBF AdvDipFA PETR CertLTCP to Director and welcomed her to the Board. After 5 years with the company, she has...