Owning a property vis a company – big tax changes

Last month, at the annual HLB International Audit & Tax Conference in Amsterdam, I spoke to member firms about the current real estate developments in the UK from a tax perspective. There have been some big changes recently, including Stamp Duty Land Tax (SDLT), the Annual Tax on Enveloped Dwellings (ATED) and ATED-related Capital Gains Tax (CGT); all of which have led to many with high value residential properties questioning: am I structured in the most tax-efficient manner? It is important that you look at the key tax considerations if:

- You are looking to buy a home and are considering the pros/cons of buying it in your company or taking money out and buying it personally (scenario 1)

- You have a company-owned home and are considering whether it is still tax-efficient to hold it in the company (scenario 2)

First, let’s look at the various property taxes you need to consider.

Stamp Duty Land Tax (SDLT)

As it now stands, SDLT is payable at the rate of 15% when a company (i.e. non-natural person) acquires a UK residential property valued at more than £500,000. In contrast, when the purchaser is an individual the rate of SDLT is tiered with a 12% rate only applying over £1.5m

Benefits in Kind (BIK)

BIK are benefits you receive from your company which are not included in salary/wages, such as a company car, medical insurance or use of a home. Some BIK are tax-free, but accommodation is not, and it could lead to a significant tax liability. The amount of BIK tax due on a home depends on a number of factors, including the rent the occupier pays (if any), the value of the property and the cost of the property if bought by the employer.

An Annual Tax on Enveloped Dwellings (ATED)

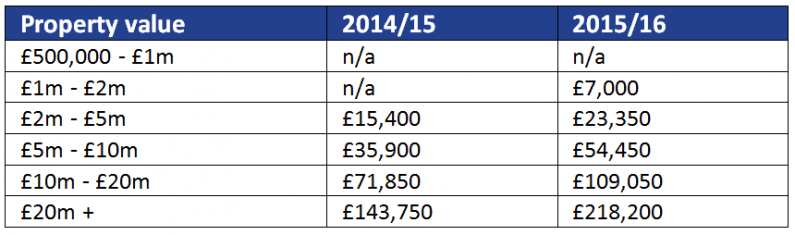

ATED is not a new tax, but it has changed considerably since its introduction in 2013. Essentially, ATED is payable by companies that own UK residential property (a dwelling) valued above a certain amount, as the below table shows. This tax is payable each year.

At first, ATED only really caught London properties, but with the properties valued between £1m – £2m now included from April 2015 (and with properties valued between £500,000 – £1m to be included from April 2016) the tax has been given a much wider scope and will affect many more companies north of the capital. Companies in the North and the Midlands really need to take note.

As well as its scope, the annual chargeable amounts for ATED have also increased significantly from April 2015 – by 50% above the usual yearly increase in line with the Customer Prices Index (CPI).

ATED-related Capital Gains Tax

Thinking of selling your company-owned property?

If your company falls within the ATED rules and pays annual tax, then you will need to watch out for ATED-related capital gains on the sale of the property. High value UK residential properties that are subject to ATED are also subject to 28% UK capital gains charged on profit (overriding the normal 20% corporation tax) when the property is sold.

ATED capital gains only applies to a property’s growth in value between 6 April 2013 (or the date on which the property first comes within the ATED regime) and the date of the sale.

Scenario 1: You have made some money in your company following the recession and now you want to buy a second home. Do you take the money out and buy it personally or buy it in the company?

With the changes to various property taxes and, in particular, the substantial increase in the ATED annual chargeable amounts, each situation must be carefully considered in its own right.

There are quite a few considerations you will need to make in addition to the ATED annual charge. You will be subject to a flat rate of 15% SDLT when purchasing the property into a company, as opposed to a much lower rate when purchased personally. This will make a big difference if your property is valued under £1.5m. For example, a property valued at £850,000 will be subject to under 5% SDLT.

As well as those points, you may also find that buying the property personally may be more beneficial when it comes to the sale of the property, particularly if this is your only residence and would be exempt from capital gains tax. Even if you are only just purchasing the property, thinking ahead early on could save you a big headache in the future! Those properties that are subject to ATED are also subject to 28% ATED-related capital gains charged on profit, rather than the usual 20% corporation tax, when the property is sold.

All of this seemingly points towards always buying the property personally. However, if you decide to take the money out of the company to do so – whether that is as a salary or dividend – you will be subject to income tax, which could be as high as 45%. Recent changes to the way dividend income is taxed will, from April 2016, also significantly reduce the tax advantage of taking dividends rather than salary, particularly for those extracting large sums from the company.

Scenario 2: You have a company-owned home and you are now considering whether it is tax-efficient.

You will also need to consider all of the above points, including ATED, SDLT, BIK, ATED-related capital gains if you currently have a company-owned home.

In particular, your annual tax charges are now likely to rise, whether that is due to an increase in your existing charge or a new charge as you become subject to ATED. The increase in ATED for the higher end of residential properties is particularly noteworthy and will make a considerable difference year-on-year. Because of this you may be looking to take the property out of the company, either by selling it to a third-party or selling it to yourself.

If you choose to sell the property to a third-party you may be subject to ATED-related capital gains, depending on the value of the property. If the property is valued between £500,000 – £1m then you could save 8% tax on the sale of your property if it is sold before that threshold comes into the ATED regime in April 2016. If your property is already subject to ATED then you will have to sell at the higher ATED-related capital gains rate.

If you choose to take the property out of the company by selling it to you, you have two options. Firstly, you may wish to do this as a dividend, although, as mentioned earlier in scenario 1, the recent announcement of planned changes to the way dividend income is taxed will significantly reduce the tax advantage of this form of remuneration. Taking it as a dividend should avoid any SDLT. The second option would be to take remuneration in the form of the property, but this is not usually as tax efficient.

In summary – is your structure right?

Now is the time to think ahead and plan strategically if you have, or are thinking about having, company-owned property. As properties valued between £500,000 – £1m are to be subject to ATED annual charges from April 2016 and the fact that the forthcoming changes to the way dividend income is taxed will significant reduce its tax advantage, it is essential to start thinking now.

The changes are likely to have a substantial impact on how you structure things. As the two scenarios above have shown, there are a number of options available to you, each of which needs to be carefully considered. We recommend you take advice as soon as possible.

More from our tax experts

You can find all of our latest tax articles and tax resources here.

If you are looking for advice in a particular area, please get in touch with your usual Hawsons contact.

Alternatively, we offer all new clients a free initial meeting to have a discussion about their own personal circumstances – find out more or book your free initial meeting here. We have offices in Sheffield, Doncaster and Northampton.