Practices must start publishing GP net earnings on their practice website by 31 March 2016.

If you are reading this article then you may be wondering what you need to disclose on your practice website in relation to the new mandatory requirement to publish the GP net earnings of your practice.

In this article we focus on what practices need to do when publishing GP net earnings including what must be published, when it must be published by, how GP net earnings are calculated and what this may mean for recruitment and retention of staff.

What do practices have to publish?

Practices must publish the mean earnings for all GPs in their practice.

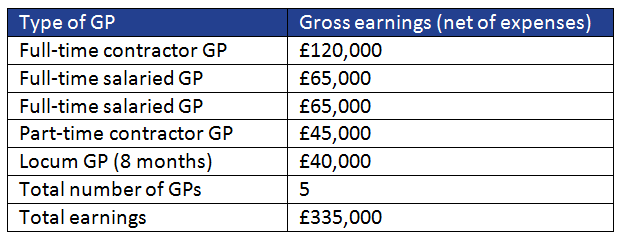

The earnings reported relate to the 2014/15 financial year and must include all GPs who worked for over six months in the practice during that particular finanical year.

The earnings do include:

- Income from NHS England, CCGs and local authorities for the provision of GP services that relate to the contract or which have been nationally determined.

- All earnings to be reported are pre-tax, National Insurance and employee pension contributions.

- For contractors the figures are net of practice expenses incurred.

The earnings do not include:

- Income and costs related to premises, dispensing, private work, out of hours or other commitments

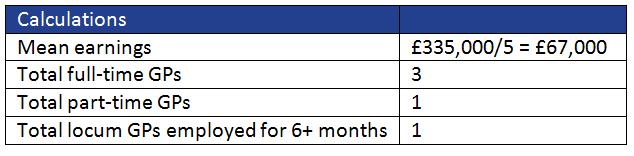

Alongside the mean figure for average earnings, practices will also be required to publish the number of full-time, part-time and locum GPs in the practice on the practice website (see example of wording below).

Are earnings published before tax and National Insurance etc.?

Yes. The information recorded when publishing GP net earnings are before tax, National Insurance and any employee pension contributions. Additionally, for partners within the practice, the earnings should be net of expenses incurred.

When do practices have to publish GP net earnings by?

The publication of GP net earnings relates to the 2014/15 financial year and should be on the practice website by the 31 March 2016 deadline. Many practices have already started to publish their information.

The information must also be made available in hard copy on request.

What constitutes full-time and part-time?

There is some confusion as what constitutes a full-time GP when calculating the mean average for GP net earnings.

NHS England guidance states that “practices are recommended to follow the definition of full time provided within the 2006/07 UK General Practice Workload Survey, namely that those GPs that work eight sessions or more are considered full time, and any GPs working less than this are considered part time.”

A session is usually defined as a half day.

How do practices calculate GP net earnings?

NHS England have acknowledged the potential difficulties in dis-aggregating income and expenditure lines in exact terms and have published detailed guidance on calculating GP net earnings and have provided some guidance on this (see below).

An example calculation of GP net earnings for the practice website is:

What wording should be published on the practice website?

An example publication for the practice website is:

“All GP practices are required to declare the mean earnings (e.g. average pay) for GPs working to deliver NHS services to patients at each practice. The average pay for GPs working in [inset practice name] in the last financial year was £67,000 before tax and NI. This calculation is for 3 full-time GPs, 1 part-time GP and 1 locum GP, who has worked in the practice for more than 6 months.”

Will the publication of practice earnings really improve transparency?

Following the initial announcement of the new contractual requirement for practices to publish practice earnings we looked at whether the new rules will really lead to greater transparency.

As you can see from the above example, the calculation mechanisms for the publication of practice earnings may actually further blur the real GP net earnings. The changes, which are being touted as an aid to increase transparency with GP earnings, will be a time-consuming process and may actually have the opposite effect. The changes could also have a consequence for recruitment and retention as well. Find out more in our article on GP net earnings and transparency here.

Will individual GP net earnings be published in the future?

There is also growing concern that the sector is heading towards the publication of individual GP earnings and, although there is no current consultation into the publication of individual earnings, there may be a consultation in due course.

The general viewpoint is that because the mean GP earnings published may have a tendency to be lower than expected, as they may be heavily influenced by part-time GPs within the practice, the publication of individual GP net earnings may come into force in the not too distant future.

We will keep you up-to-date with any additional developments.

Where can practices find more information?

NHS England has produced detailed guidance on the publication of net earnings, which includes a worked example of how to calculate and publish the information. You can read the guidance here.

More from our GP practice experts

You can find all of our latest GP practice sector news and newsletters here.

If you are looking for advice in a particular area, please get in touch with your usual Hawsons contact.

Alternatively, we offer all new clients a free initial meeting to have a discussion about their own personal circumstances – find out more or book your free initial meeting here. We have offices in Sheffield, Doncaster and Northampton.

Scott Sanderson

Scott Sanderson began his career with Hawsons and trained as a Chartered Accountant, becoming a partner in 2015, specialising in the healthcare sector and small businesses. For more details and advice, please contact Scott on ss@hawsons.co.uk or 0114 266 7141.[/author_info]