Welcome to our retail 2016 Budget review

Following a year in which the Chancellor had a pre-election Budget in March, a surprise summer Budget in July and an Autumn Statement in November, on 16 March the Chancellor delivered his first Budget of 2016.

Following an Autumn Statement in which the Chancellor failed to give any clarity on the future of retail rate relief, in the lead up to the 2016 Budget there were strong calls from retailers across the UK for the government to reform its plan for business rates. With rising costs including the apprenticeship levy, auto enrolment and the introduction of the new National Living Wage, retailers warned the government that without the vitally important retail rate relief there would be real pressures on employment (recruitment and retention) in high street retailers.

In this retail 2016 Budget review we summarise the key points and developments arising from the 2016 Budget and focus specifically on what the changes may mean for the retail sector.

Budget summary (retail specific):

- Increases in business rate relief for small businesses

- Corporation Tax will be cut again to 17% in 2020

- New stamp duty rates for commercial property from 17 March 2016

- Fuel duty to be frozen again

- Increased investments in road and rail

- New measures to tackle unfair online competition

- Capital Gains Tax rates will be cut from 6 April 2016

- HS3 between Leeds and Manchester to go ahead

- Personal Allowance to increase to £11,500 in April 2017

- Higher-rate threshold will increase to £45,000 in April 2017

Retail 2016 Budget impact

A good 2016 Budget for retailers – but where next for retail rate relief?

Pete Wilmer, Partner at Hawsons, commented: “This year’s Budget brought good news for retailers and particularly good news for small retailers. Although the Chancellor did not provide clarity on the retail rate relief or the new apprenticeship levy, the changes to business rate relief and freeze in fuel duty are both positive developments.”

Business rate relief for small businesses

The £1,500 retail rate relief could be an invaluable relief for small retailers, but was once again missed off the agenda in the Chancellor’s Budget. However, the Chancellor did announce a progressive approach to business rates, which will bring good news for retailers up and down the country. The Chancellor announced that business rate relief for small businesses will more than double from £6,000 to £15,000. This increase to the annual limit will exempt thousands of small businesses, with 250,000 businesses paying less in business rates.

Sage data shows that, prior to the 2016 Budget, more than one in three UK small businesses said that reforming business rates would have the biggest impact in transforming their company. This is a big boost for small businesses and particularly for retailers, who argue that, in the digital age, those who have bigger physical presences (than those with big online presences) are taxed unfairly and uncompetitively.

Pete added: “The government provided some much needed clarity in its highly anticipated overhaul of business rates – even with the exception of retail rate relief – in the 2016 Budget. The business rate relief is critically important to the sustainability and stability of many high street shops, so with the rate more than doubling this is of course good news.”

Freezing of fuel duty

The fuel duty freeze will be extended for another year, taking it to 6 years at the current rate at the end of 2016/17. This is good news for both drivers and small business owners and will be welcomed across the country. The freezing of fuel duty will particularly benefit those who use vans or who take delivery of goods (e.g. retailers and hospitality firms) where using large amounts of fuels is unavoidable. As an example, the Chancellor announced that this would see a saving of an average of £270 for a small business with a van.

Pete added: “The freezing of fuel duty for yet another year is welcome news for the retail sector. High street shops and online retailers all rely on the delivery of goods in some capacity – whether it’s to the shop or delivering to customers – so a frozen fuel duty is again good news.”

Tackling unfair online competition

The government also announced new measures to take “firm action” to protect the UK retail market from unfair online competition. The government said that: “some overseas traders from beyond the EU avoid paying UK VAT, undercutting online and high street retailers and abusing the trust of UK consumers who purchase goods via online marketplaces….(and) Budget 2016 announces action that will help to protect consumers and level the playing field for businesses.”

Carbon reduction commitment

The Chancellor said in his Budget speech: “Many retailers have complained bitterly to me about the complexity of the Carbon Reduction Commitment – it’s not a commitment, it’s a tax. So I can tell the House, we’re not going to reform it. Instead, I’ve decided to abolish it altogether… the most energy-intensive industries remain completely protected and I’m extending the climate change agreements that help many others.”

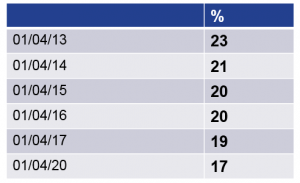

Corporation tax

Corporation tax rates were once again cut by the Chancellor in the 2016 Budget, which will of course bring tax opportunities for small businesses and their owners. The tax rate currently stands at 20% and was proposed to fall to 18% by 2020 (announced in the 2015 Budget), but will now fall to 17%.

The below table shows have corporation tax rates have been on a downward trend in recent years.

For more information

More from our retail experts

You can find all of our latest retail sector news and newsletters here.

If you are looking for advice in a particular area, please get in touch with your usual Hawsons contact.

Alternatively, we offer all new clients a free initial meeting to have a discussion about their own personal circumstances – find out more or book your free initial meeting here. We have offices in Sheffield, Doncaster and Northampton.