Welcome to our transport and logistics 2016 Budget review

Following a year in which the Chancellor had a pre-election Budget in March, a surprise summer Budget in July and an Autumn Statement in November, on 16 March the Chancellor delivered his first Budget of 2016.

In this transport and logistics 2016 Budget review we summarise the key points and developments arising from the 2016 Budget and focus specifically on what the changes may mean for the transport and logistics sector.

Budget summary (transport and logistics specific):

- Increases in business rate relief for small businesses

- Fuel duty to be frozen again

- Corporation Tax will be cut to 17% by 2020

- Increased investments in road and rail

- Seven Bridge tolls to be halved

- £300m transport funding boost

- HS3 between Leeds and Manchester to go ahead

- Personal Allowance to increase to £11,500 in April 2017

- Higher-rate threshold will increase to £45,000 in April 2017

Transport and logistics 2016 Budget impact

A positive 2016 Budget for the transport and logistics sector

Paul Wormald, Partner at Hawsons, commented: “With increased investments in rail and roads, another check on fuel duty, Seven Bridge tolls to be halved and reductions in other key business taxes, this was once again a positive Budget for the transport and logistics sector.”

“The Chancellor claimed that it was ‘a Budget that backs small businesses’ and ‘a Budget for the next generation’ and, indeed, most of the headline announcements focused around small businesses and savings. But those announcements mentioned above will be very welcome news for the transport and logistics sector, particularly now as we move into an uncertain period leading up to the EU referendum.”

“It was, however, disappointing that there were no further announcements on the apprenticeship levy and the dividend income changes, both of which bring significant changes to transport and logistics businesses and their owners.”

Freezing of fuel duty

In the lead up to the 2016 Budget there was strong speculation that the Chancellor would look to increase fuel duty for the first time in four years. However, this was not proven to be the case.

The fuel duty freeze will be extended for another year, taking it to 6 years at the current rate at the end of 2016/17.

Paul add: “Using vast amounts of fuel is unavoidable in the transport and logistics sector and any kind of increase in fuel duty would have been a big blow for all businesses, but particularly haulage firms. It is good to see that the Chancellor has not used falling fuel prices as an opportunity to reduce the deficit. The Chancellor said a small business with a van would see an average saving of around £270, but in the transport and logistics sector, where haulage is its brick and mortar, the average saving is likely to be in the thousands.”

More investment for transport and the Northern Powerhouse

The Chancellor confirmed the backing of two major rail projects in a package to boost transport links, as was reported the day before the 2016 Budget. The big transport funding boost for the sector included number of projects.

One is the start of investigatory work on building HS3, an east-west railway across the north of England, with the first section running under the Pennines to provide a faster railway between Leeds and Manchester. Ultimately, the travel time could come down to 30 minutes. The scheme is expected to include a combination of new build and upgrades of existing railways, and eventually extend right across the north from Liverpool in the west to Hull in the east.

The Chancellor also announced further investment for road infrastructures, committing more than £230m for road improvements – including the delivery of a four-lane M62.

Paul added: “We have spoken on many occasions about the importance of investing in the UK’s transport infrastructure and knock-on effects this would have on the local and national economy. The announcements from the Chancellor in his latest Budget are once again positive developments and are indicative of his plans for a Norhern Powerhouse.”

“Although detailed figures will only be announced in due course, it is known that an initial £300m will be allocated to developing HS3, as well as a proposed road tunnel under the Pennines and other highway improvements, while Crossrail 2 will receive an initial grant of £80 million. Transport for London will be asked to find match-funding of the same amount, with the aim of introducing a Bill to authorise the project in this Parliament.”

Seven Bridge tolls to be halved

The Chancellor announced in his 2015 Budget that Seven Bridge tolls for cars and vans were to be cut to £5.40 in 2018; however, he has now gone one step further and, subject to consultation, tolls will halve. The current charge – only paid by vehicles travelling from England into Wales – is £6.60 for cars, £13.20 for vans and £19.80 for lorries and buses.

Further details are likely to be announced in due course.

Corporation tax

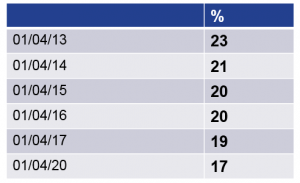

Corporation tax rates were once again cut by the Chancellor in the 2016 Budget, which will of course bring tax opportunities for transport and logistics firms. The tax rate currently stands at 20% and was proposed to fall to 18% by 2020 (announced in the 2015 Budget), but will now fall to 17%.

The below table shows have corporation tax rates have been on a downward trend in recent years.

A reduction in corporation tax rates will likely have a knock-on effect on business confidence.

Business rate relief for small businesses

The Chancellor announced a progressive approach to business rates, with the business rate relief for small businesses more than doubling from £6,000 to £15,000. This increase to the annual limit will exempt nearly thousands of small businesses, with 250,000 businesses paying less in business rates.

Sage data shows that, prior to the 2016 Budget, more than one in three UK small businesses said that reforming business rates would have the biggest impact in transforming their company. This is a big boost for small businesses and particularly for retailers, who argue that, in the digital age, those who have bigger physical presences (than those with big online presences) are taxed unfairly and competitively.

For more information

More from our transport and logistics experts

You can find all of our latest transport and logistics sector news and newsletters here.

If you are looking for advice in a particular area, please get in touch with your usual Hawsons contact.

Alternatively, we offer all new clients a free initial meeting to have a discussion about their own personal circumstances – find out more or book your free initial meeting here. We have offices in Sheffield, Doncaster and Northampton.

Paul Wormald is a partner at Hawsons, working in the Doncaster office. He worked previously with two national firms of Chartered Accountants prior to joining Hawsons in 2001. For more information or advice on anything covered in this article, please contact Paul on pw@hawsons.co.uk or 01302 367 262.[/author_info]