An independent party conducts an audit to investigate a company’s financial report. The audit aims to provide assurance (different from a guarantee) that the financial statements are true and fair according to the relevant financial reporting framework. Typically, there are three types of audits: Financial Audit, Compliance Audit, and Operational Audit.

Financial Audit

The most common type of audit is typically a financial audit. In a financial audit, an audit firm evaluates a company’s financial accounts to assure they have been prepared properly and show a fair representation of the organisation’s financial position. An external independent audit firm normally completes this process.

Compliance Audit

A compliance audit report conducts a detailed review to determine if your business or organisation complies with specific regulatory guidelines.

Operational Audit

This type of audit reviews how your organisation conducts its business. The aim is to improve your organisation’s efficiency and effectiveness.

Is it compulsory to have an audit?

The Compliance Act requires all companies above a certain size to undergo a financial audit (known as a statutory audit). However, the following companies must undergo an audit, irrespective of size:

-

A public company (unless it’s dormant)

-

A subsidiary company (within a group which is not small)

-

An authorised insurance company or one carrying out insurance market activity

-

Companies involved in banking or issuing e-money

-

A Markets in Financial Instruments Directive (MiFID) investment firm or an Undertakings for Collective Investment in Transferable Securities (UCITS) management company

-

A corporate body whose shares have been traded on a regulated market in a European state.

For periods commencing on or after 1 January 2016, your company qualifies for an audit exemption if it meets two of the following criteria:

-

Annual turnover is no more than £10.2 million

-

Gross assets amount to no more than £5.1 million

-

The average number of employees is 50 or fewer.

(Source: https://www.gov.uk/audit-exemptions-for-private-limited-companies)

What is the purpose of a financial audit?

The purpose of an audit is for a qualified independent party to examine your financial reports. A professional conducts an objective evaluation to determine if the financial report has been presented fairly according to the accounting framework. In some cases, a clean, unqualified report can enhance your business’s credibility with lenders, creditors, and investors.

The audit process

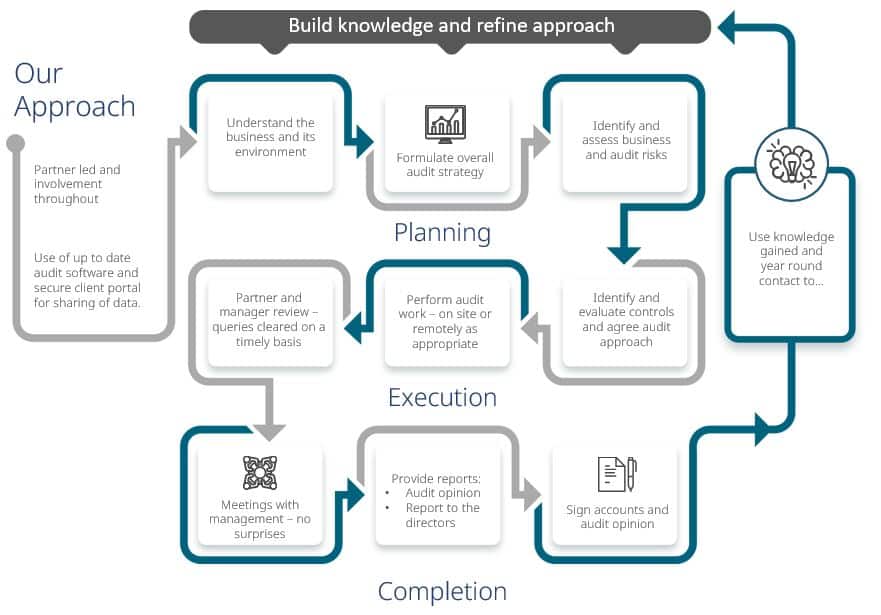

Every audit is unique, but the following is a list of some typical steps that auditors often take during external audits:

-

The company or organisation prepares its financial report according to the appropriate legal and financial requirements.

-

The auditor gains an overview and understanding of the company, considering any external factors that could have impacted the business in the reporting period.

-

The auditors look at the financial information, identify, consider, and assess any risks, and investigate the company’s infrastructure to see what protocols are in place to mitigate those risks.

-

Once risks have been identified, the auditor examines the financial report, considering these risks to ensure its accuracy.

-

The auditor uses their knowledge of the business and areas of risk to direct their approach.

-

The auditor performs tests of the financial information supporting the financial report and issues an opinion on the accuracy of the financial report.

Below is the typical process of how we would conduct an Audit.

What are the advantages of an audit?

-

An audit provides reassurance to directors, shareholders, and other stakeholders that financial statements are materially correct.

-

It identifies weaknesses within the accounting process and recommends ways to improve.

-

Auditors inform you of any changes in accounting standards and tax legislation to ensure you are prepared ahead of time.

-

For some lenders, an audit can be a requirement and can improve your chances of being accepted for a loan application.

-

An audit reassures customers and suppliers that your finances are in order.

How can we help?

An audit can provide your business with numerous benefits. If you are considering having an audit please do get in touch for a free initial meeting or visit our audit page for more information. Hawsons have offices in Sheffield, Doncaster, and Northampton. We have an established reputation for integrity and professional competence of which we are proud and committed to maintain. Our team of audit experts is fully trained on the latest developments in Auditing Standards which is becoming an increasingly specialised area.

Related content

FRS102 revenue and lease overhaul delayed until 2026

The Financial Reporting Council (FRC) has decided to push back its timetable for drafting changes to FRS102 and other financial reporting standards. Originally, it was thought that the final amendments would be ready in the first half of 2024 and be effective for...

IASB publishes guidance on the effects of climate-related matters on financial statements for SMEs

On 16th May, the IASB published guidance regarding the effects of climate related matters on financial statements prepared in accordance with the IFRS for SMEs financial statements. Full guidance can be found here. The guidance contains examples of areas where...

Government to simplify non-financial reporting rules

The government is currently consulting on various options to simplify non-financial reporting rules indicating consideration of the appropriateness of the current company thresholds. The Department for Business and Trade (DBT) and Financial Reporting Council (FRC) are...