Big care home compliance changes As part of the revised compliance standards to be implemented by Care Quality Commission (CQC) it is vital for home operators to be aware of the financial aspects that the changes in legislation mean for them. From 1 April 2015, CQC...

Latest News

What Budget 2015 means for pensions

What Budget 2015 means for pensions After the revolutionary pension reforms and new flexibilities that came from the 2014 Budget, this year, in comparison, announced only minor changes. The further changes to pensions that the Chancellor introduced in the 2015 Budget...

Reducing the cost of buying a home – SDLT reform

Reducing the cost of buying a home - SDLT reform One of the welcome announcements in the Autumn Statement included the immediate reform of Stamp Duty Land Tax (SDLT) on the purchase of residential property. Until this announcement SDLT was charged at a single...

Big changes to SRA Accounts Rules

Big changes to SRA Accounts Rules Following a consultation period, which ran between May and June last year, the Solicitors Regulation Authority (SRA) announced, in September 2014, that a three-stage process regarding the proposed new changes to the SRA Accounts Rules...

Year End Tax Planning 2015

Year End Tax Planning 2015 Would you like the opportunity to reduce the taxman's take from your own and your family's income? If so read on, as carrying out an annual review of your tax affairs could significantly reduce your own and your family’s tax liabilities. The...

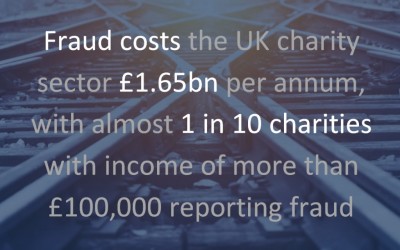

The Price, Detection and Prevention of Charity Fraud

The vulnerability and price of fraud No sectors are immune to fraud and the charity sector is no different. In fact, charities can sometimes be seen as soft targets. Some of the possible reasons for this include: To a certain degree, many charities still rely on...

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Big care home compliance changes – are you ready?

Big care home compliance changes As part of the revised compliance standards to be implemented by Care Quality Commission (CQC) it is vital for home operators to be aware of the financial aspects that the changes in legislation mean for them. From 1 April 2015, CQC...

What Budget 2015 means for pensions

What Budget 2015 means for pensions After the revolutionary pension reforms and new flexibilities that came from the 2014 Budget, this year, in comparison, announced only minor changes. The further changes to pensions that the Chancellor introduced in the 2015 Budget...

Reducing the cost of buying a home – SDLT reform

Reducing the cost of buying a home - SDLT reform One of the welcome announcements in the Autumn Statement included the immediate reform of Stamp Duty Land Tax (SDLT) on the purchase of residential property. Until this announcement SDLT was charged at a single...